Five Things Every Business Owner Need To Do ASAP

- Call your bank and ask for 3-6 month loan deferment. The rates are so low that the banks are willing to do refinancing and roll the deferred payments in. In addition, SBA can loan you up-to $2M to fight the situation, visit its site.Economic Injury Disaster Loans SBA webinar – 3/20/20:

Direct loan from US Treasury (not thru the bank like other SBA loans) – customer applies online at: disasterloan.sba.gov or Sba.gov/disaster

Available to small business and private non-profit organizations (any nonprofit not owned by gov’t, so most of our nonprofits would qualify)Must be directly affected by the disaster and in a disaster area. MN is not yet but expect it to be soon

Must have the ability to repay the SBA loan and have working capital losses directly due to the corona virus

11 month deferment – 1st payment is due 1 year from the date on the promissory note

Up to $2MM

Up to $25,000 unsecured

Real estate as collateral even if there isn’t enough equity to fully collateralize. Will take ABA, vehicles, machinery, equipment.

Interest rate of 3.75% for small business or 2.75% for nonprofits

No fees

Term loans, not RLOC’s. Terms up to 30 years.

Funds are to be used for ongoing operations – to keep the business in business. Not intended to replace lost sales, expansion, refinance credit card debt or other debt

No cost to apply. No obligation to take the loan if offered. Can cancel/withdraw. Has up to 6 mos from the date of letter to access funds (but will need updated financials at that time)

Required info: Loan applications, 4506T, most recent tax return, sch of liabilities, PFS, 2019 financial statements, interims, etc.

Download paper application before applying online so you know everything that is needed

Appraisal is not necessarily required if RE is taken as collateral - IRS has extended the payment deadline from 4/15 to 7/15. MN might do the same but for now it has extended Sales Tax payments by 30 days. The counties and cities might be doing the same to property taxes, license fees etc. Conserve cash.

- If your employees file for unemployment, MN is not increasing your premiums so don’t stress out about laying people off. Save the mother ship (business). Some of the business owners might qualify for the unemployment, as well.

- Over the last decade, the low employment rate has pushed the wages up and quality of talent down. This is the time to correct that. Let go the under performers and adjust everyone else to the new market rates.

- Ask your landlords to abate Rent for 3-6 months. Also ask for lowering the rent going forward to new market reality. Since banks are working with the landlords, they should be able to transfer some of the benefits to you. Please keep in mind that the lease might have a clause to protect you in this situation.

Recent Post

View all Post

Many small business owners pay for business expenses out of their own pocket—because it’s faster, easier,…

You finally caught a break—your lender forgave part (or all) of your business debt. But now…

Recent changes to U.S. trade policy are once again shifting the financial ground for small businesses—especially…

When you hear “research and development tax credit,” you might picture scientists in lab coats or…

Homeowners across Minnesota have long aired frustrations over aggressive homeowners association (HOA) boards—associations levying arbitrary fines,…

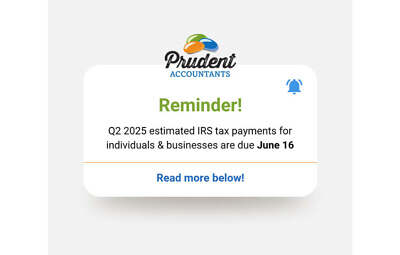

For many small business owners and self-employed professionals, tax season may feel like it ends in…